Your First Bank Account? Here's What You Need to Know

Opening your first bank account is a big step toward independence—and adulting! Whether you're working a part-time job, getting an allowance, or just want a place to stash birthday cash, choosing the right bank and account can make a huge difference in how you manage your money.

It might seem like all banks are basically the same, but they're not. From hidden fees to mobile apps that barely work, some accounts are better for teens than others.

This guide will walk you through everything you need to know before opening your first bank account—so you can make a smart, confident choice.

Understand The Different Types Of Bank Account

Before you pick a bank, you should know what kind of account you're actually opening:

Current Account – Great for daily spending. It comes with a debit card and lets you make purchases, pay bills, and withdraw cash.

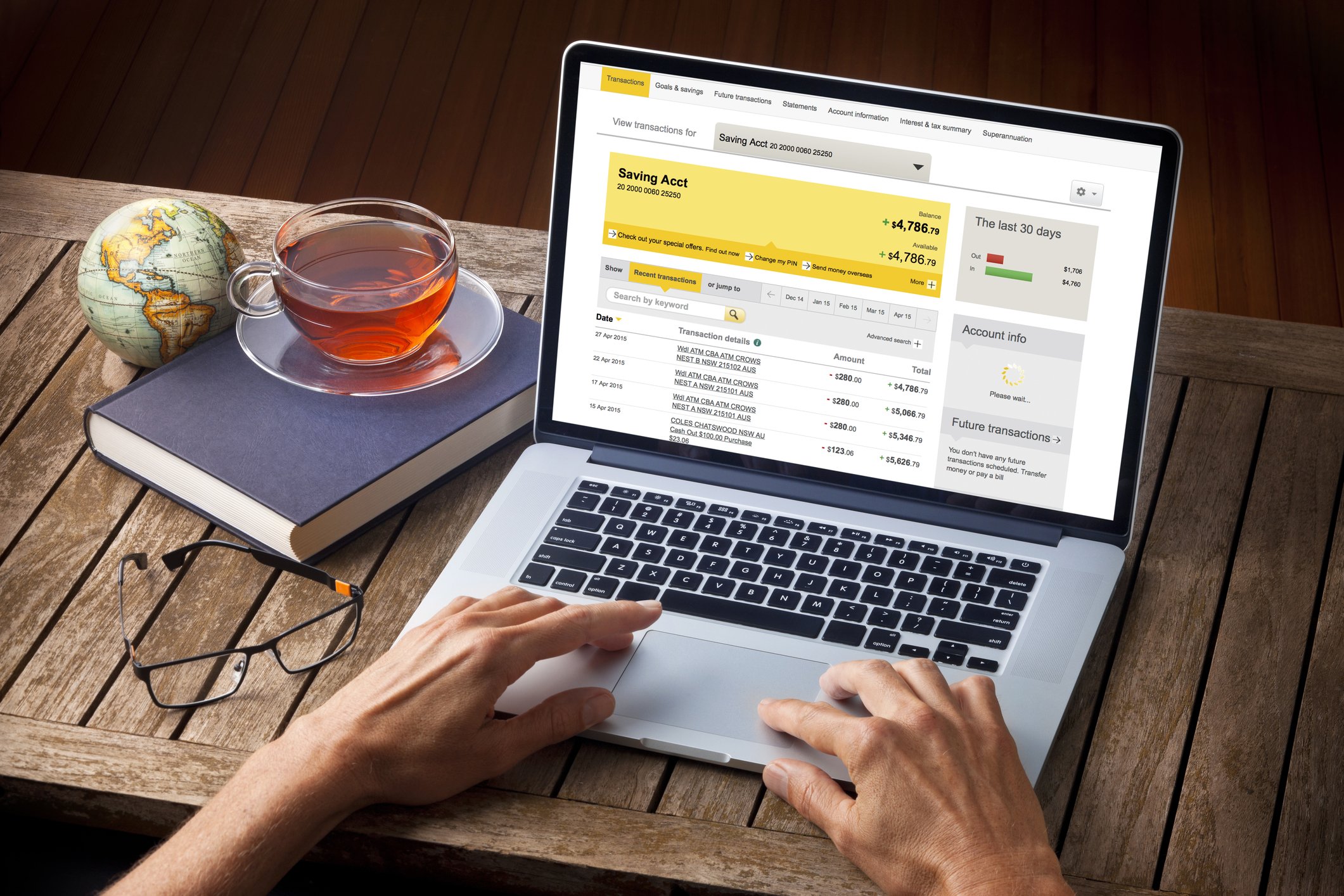

Savings Account – A place to grow your money over time. You’ll earn a small amount of interest, and it’s designed to help you save, not spend.

Pro Tip: Some banks offer teen accounts that combine both checking and savings, with features made just for young people.

Look For No Monthly Fees

Banks love fees. But you shouldn’t have to pay just to keep your money safe. When picking an account, look for:

No monthly maintenance fees

No minimum balance requirements

No overdraft fees (especially important if you’re still learning to track spending)

Some banks offer student or teen accounts that automatically waive these charges.

Check For Mobile App Features

You live on your phone—your bank should, too. A good mobile app makes managing your money way easier. Look for apps that let you:

Check your balance in real time

Set up alerts (like when your account is low)

Deposit checks just by taking a picture

Send or receive money with friends

The app should be user-friendly, not something that feels like it was made in 2005.

Watch Out For Cash Machine Access

Want to avoid paying £3 just to grab your own cash? Make sure your bank has plenty of cash machines nearby—or reimburses fees when you use out-of-network ones. National banks often have a wide network, but some online banks offer great cash machine access too.

Tip: If you're going away to college soon, check if the bank has cash machines or branches near your school.

Understand Parental Involvement

Most banks require a parent or guardian to help you open an account if you're under 18. This is called a joint account. Your parent will have access to your account, but they can also help you learn the ropes—like reviewing statements or setting a budget.

When you turn 18, you can usually convert the account to your name only.

Think Long-Term

Some banks offer perks for staying loyal—like transitioning you to a student account with better features when you head to college. Others might have basic budgeting tools or even educational resources to help you learn more about money.

Starting off with a bank that grows with you is a smart move.

Final Thought

Opening your first bank account is more than just getting a debit card—it's your first step into managing real money. The key is to find a bank that’s transparent, teen-friendly, and fits your lifestyle. Ask questions, compare options, and don’t settle for an account that charges fees just for existing.

Remember, you're not just choosing a bank—you're choosing a financial partner. Make it count.

Money Saving Expert is a journalistic website that aims to provide the best MoneySaving guides, tips, tools and techniques for people of all ages.