Swipe Smart: How Debit Cards Really Work

Getting your first debit card feels exciting—like a passport to independence. You can tap, swipe, and spend without needing cash. But here’s the catch: your debit card is directly connected to your money. Every time you use it, you’re spending your own funds—not borrowing from the bank.

That’s why knowing how debit cards work—and how to use them responsibly—is so important. One careless swipe can lead to overdraft fees, denied payments, or even fraud.

This post will walk you through how debit cards actually function, the pros and cons, and the smartest ways to use them without ending up broke or in trouble.

What Is A Debit Card

A debit card is a payment card that lets you spend money straight from your bank account. It works in stores, online, and at ATMs.

Unlike a credit card (which borrows money you have to pay back), a debit card pulls money directly from what you already have.

You can use it to:

Make purchases in-store or online

Withdraw cash from ATMs

Pay for subscriptions or bills (like Spotify or Netflix)

Transfer money to friends or family

But you can’t:

Spend more than you have (unless your bank allows overdrafts)

Build a credit history (since you're not borrowing money)

How Debt Cards Work Behind The Scenes

Here’s what happens when you use your debit card:

You swipe, tap, or enter your card details.

The card sends a request to your bank to check if you have enough money.

If approved, the amount is instantly deducted from your bank account.

The transaction is complete—often within seconds.

That’s why it’s important to always check your balance before spending. If there’s not enough in your account, the transaction might be declined—or worse, it might go through and land you in an overdraft.

Pros And Cons Of Using A Debit Card

Pros:

No debt: You’re spending your own money, not borrowing.

Easy access: Great for everyday use—no need to carry cash.

Control: Helps you learn budgeting and financial responsibility.

Widely accepted: Use it almost anywhere, including online stores.

Cons:

No credit building: Debit card use doesn’t affect your credit score.

Risk of overdrafts: You can go negative if you're not careful.

Limited fraud protection: If your card is stolen, getting your money back may take time.

Tips For Using Your Debit Card Responsibly

Having a debit card gives you freedom, but it also comes with responsibility. Here’s how to stay in control:

1. Track Your Spending

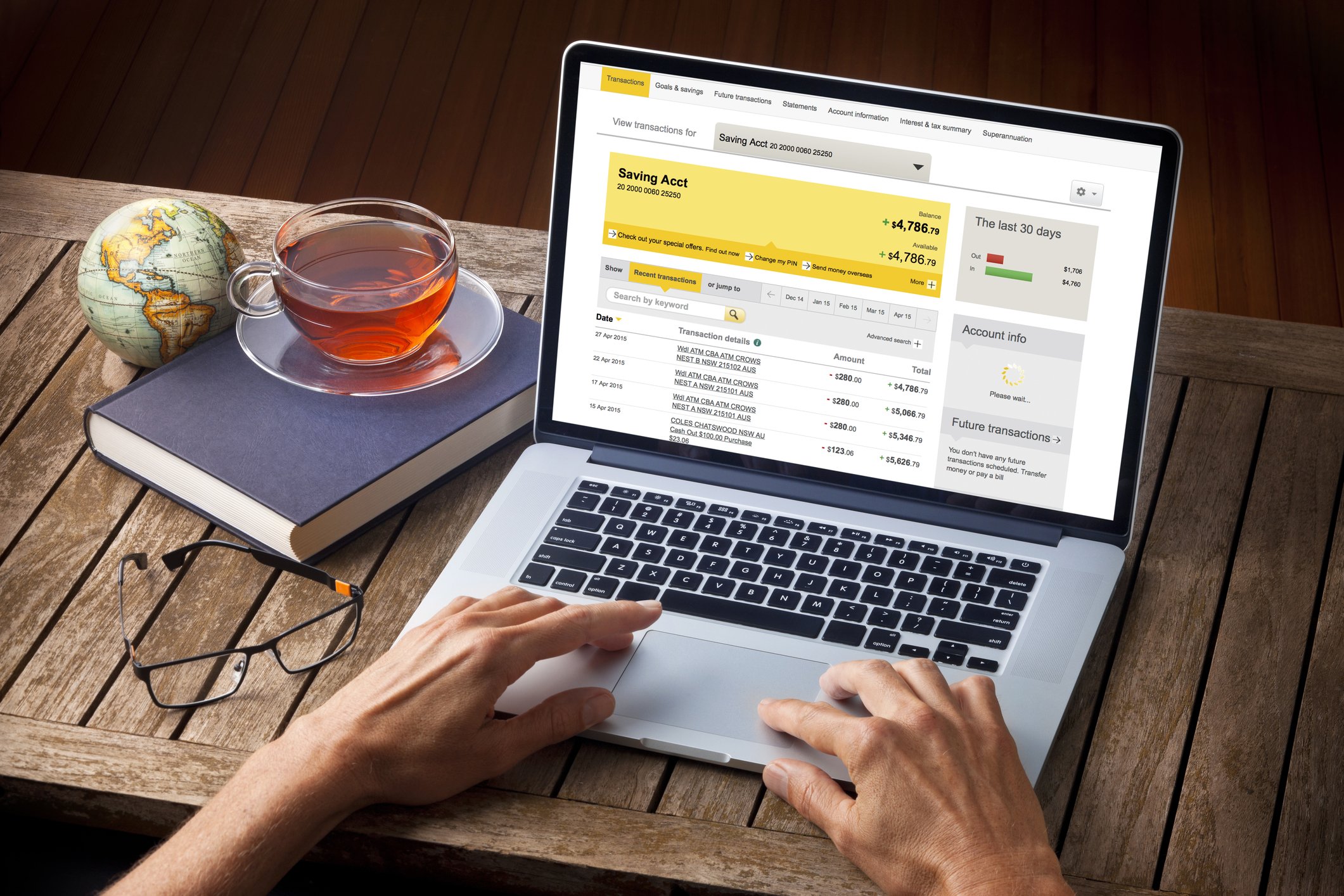

Use your bank’s app to check your balance and transactions regularly. Don’t just guess how much you have left—know for sure.

2. Avoid Overdrafts

If your account hits zero, your bank might still let a payment go through—and then charge you for it. That’s an overdraft, and it can add up quickly. Ask your bank to disable this feature if you want to avoid it completely.

3. Keep Your Card Info Safe

Never share your card number, PIN, or banking login with anyone—even friends. If you lose your card or suspect fraud, report it to your bank immediately.

4. Set Spending Alerts

Most apps let you turn on notifications for every time your card is used. It’s a great way to stay on top of spending and spot anything suspicious fast.

5. Be Smart About Online Purchases

Only shop from trusted websites. If a site looks sketchy or asks for weird info, back out. It’s better to miss a sale than lose your money.

Final Thought

Your debit card is a powerful tool—but only if you use it wisely. It makes spending easy, but that ease can get you in trouble if you’re not paying attention. The key is to swipe smart: check your balance, spend within your means, and protect your account like it’s your digital wallet—because it is.

Master your debit card now, and you’ll be one step ahead on the road to financial independence.

Money Saving Expert is a journalistic website that aims to provide the best MoneySaving guides, tips, tools and techniques for people of all ages.