Think You Don’t Need a Bank Account Yet? Think Again

If you’re a teen, chances are you’ve thought, “I don’t need a bank account yet—I’m not even making real money.” Totally normal. But here’s the truth: waiting too long to open a bank account is like trying to learn to drive the day before your driving test. You’ll wish you had started earlier.

A bank account isn’t just for adults—it’s your first real tool for managing money, building habits, and staying in control. Whether you're earning allowance, babysitting, doing side gigs, or just getting birthday cash, it’s time to learn how this works.

What Is A Bank Account, Really?

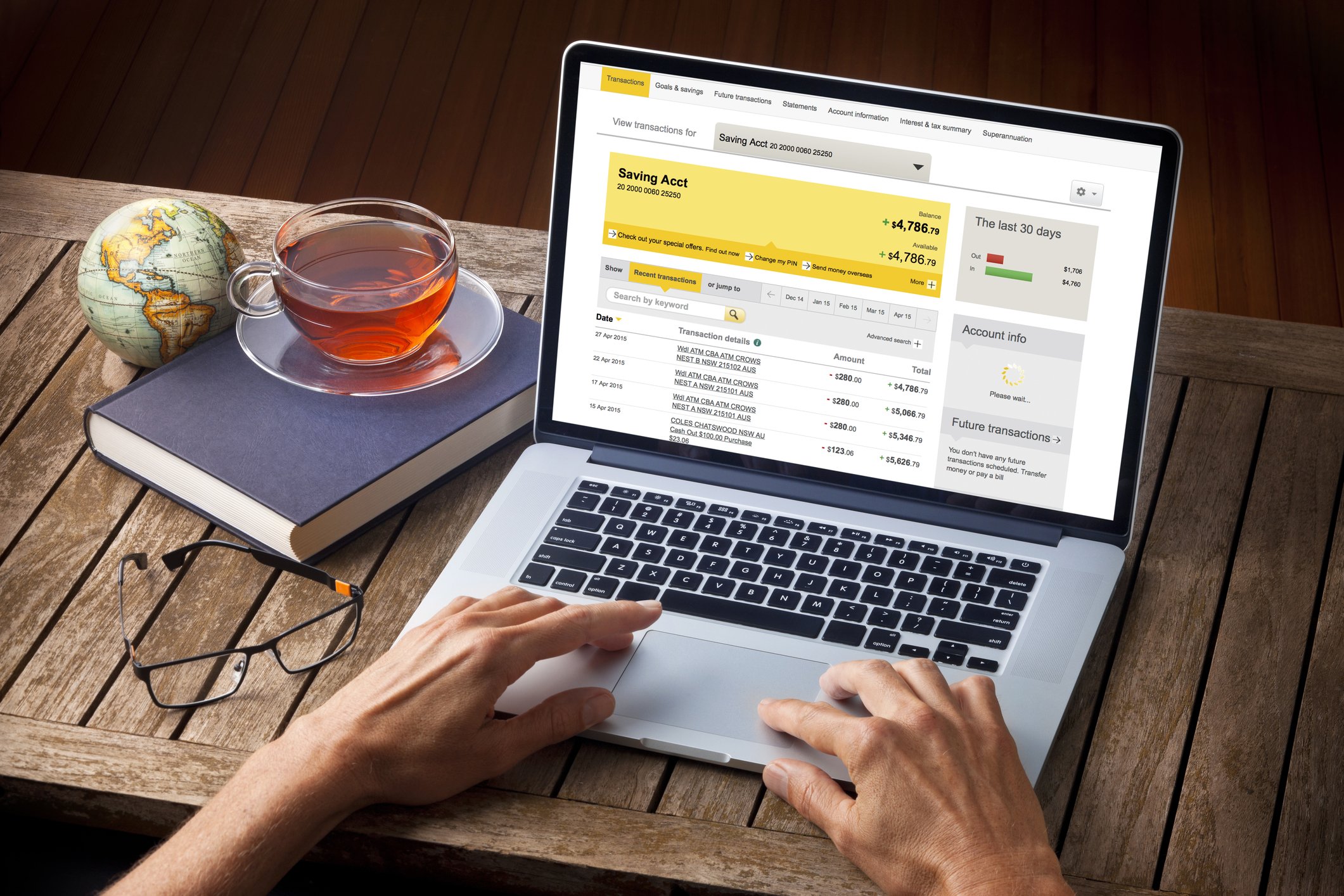

A bank account is a safe place to keep your money. Instead of stashing cash under your mattress or in a sock drawer, you put it in the bank. The bank keeps it secure and lets you access it easily using things like a debit card, mobile app, or cash machine.

There are two main types of accounts most teens start with:

Savings Account: For storing money you don’t plan to touch right away. You might even earn a little interest (free money just for saving).

Current Account: For money you’ll be spending—on food, clothes, or whatever. Comes with a debit card you can use online or in stores.

Why Do You Need One

Here’s what having a bank account can do for you:

Keeps your money safe – Way safer than carrying cash or losing it in your room.

Helps you build money skills – You learn how to manage deposits, withdrawals, and track spending.

Prepares you for real life – Most jobs pay you through direct deposit. You’ll need a bank account to get paid.

Builds trust with money – The earlier you start, the more confident you get about handling your own finances.

Even if you’re just getting small amounts of money here and there, a bank account shows you how to handle money, not just spend it.

How To Open A Bank Account

If you're under 18, you may need a parent or guardian to help you open a bank account. Here’s the basic process:

Pick a bank – Choose one that offers teen accounts, has no monthly fees, and good mobile features.

Show Your ID – You’ll need some form of ID (like a birth certificate or passport) and your parent may need to counter sign and show theirs too.

Deposit money to open it – Most banks let you open an account with as little as £5 or £10.

Download the app – Manage your account on your phone to check balances and track spending easily.

Ask questions when you open it. There’s no such thing as a dumb question when it comes to your money.

What You Can Do Once You Have One

Having a bank account opens up a ton of helpful habits and features:

Set up automatic savings goals.

Learn how to budget by tracking what goes in and out.

Start using a debit card safely and smartly.

Set up direct deposit for part-time or summer jobs.

Avoid carrying too much cash around.

You don’t need to wait until you’re making big money to use these tools. The habits matter more than the amount.

Final Thought

Getting a bank account isn’t about being “grown-up”—it’s about being smart. It helps you manage what you have, plan for what you want, and avoid money mistakes later. The earlier you start, the more in control you’ll be. So if you’ve been putting it off, it’s time to change that.

Your future self (and your future wallet) will be glad you did.

Money Saving Expert is a journalistic website that aims to provide the best MoneySaving guides, tips, tools and techniques for people of all ages.