Blog

Money & Finance

Welcome to your go-to guide for all things money! This blog is here to help teens build smart financial habits early—whether you're earning your first paycheck, saving up for something big, or just trying to figure out how money works. From budgeting and banking to spending wisely and planning for your future, we break it all down in a way that actually makes sense. Because being confident with money isn't just about math—it's about mindset. Let’s get started.

““The way you handle money today shapes your future tomorrow. It’s not about how much you have, but how smartly you use it. When you start making intentional choices—saving, budgeting, and investing—you’re not just managing money; you’re building the freedom to live the life you want.””

How to Start Building Credit (Without Getting into Debt)

When you hear the word “credit,” you might immediately think of credit cards, loans, or even debt. But what if we told you that it’s totally possible to build a strong credit history without racking up bills you can’t afford to pay?

Your credit history is like a financial reputation. It tells banks, landlords, and even future employers how responsible you are with money. And while most people assume you need to borrow loads of cash to build credit, there are smart, safe ways to get started—even as a teen—without taking on any debt at all.

Swipe Smart: How Debit Cards Really Work

Getting your first debit card feels exciting—like a passport to independence. You can tap, swipe, and spend without needing cash. But here’s the catch: your debit card is directly connected to your money. Every time you use it, you’re spending your own funds—not borrowing from the bank.

That’s why knowing how debit cards work—and how to use them responsibly—is so important. One careless swipe can lead to overdraft fees, denied payments, or even fraud.

This post will walk you through how debit cards actually function, the pros and cons, and the smartest ways to use them without ending up broke or in trouble.

Overdrafts Explained: What They Are and How to Avoid Them

So, you’ve got your first bank account, your shiny debit card, and maybe even a bit of cash from a part-time job. You’re spending smart… until one day you check your balance and it’s below zero. Worse, your bank just charged you a fee—and you didn’t even realise you did anything wrong.

Welcome to the world of overdrafts. They can be sneaky, expensive, and completely avoidable—if you know what to watch out for.

This post breaks down what overdrafts are, the difference between agreed and unapproved overdrafts, and—most importantly—how you can avoid falling into the red.

Savings vs. Current Account: What’s the Real Difference?

When you're just getting started with banking, all the different account names can feel a little overwhelming. Savings account? Current account? Aren’t they basically the same thing? Not quite.

Understanding the difference between a savings and current account is key to making smarter money decisions—especially as you start handling your own finances. Whether you're saving for something big or just need a way to spend and manage money, knowing how these accounts work (and when to use them) will set you up for success.

Your First Bank Account? Here's What You Need to Know

Opening your first bank account is a big step toward independence—and adulting! Whether you're working a part-time job, getting an allowance, or just want a place to stash birthday cash, choosing the right bank and account can make a huge difference in how you manage your money.

It might seem like all banks are basically the same, but they're not. From hidden fees to mobile apps that barely work, some accounts are better for teens than others.

This guide will walk you through everything you need to know before opening your first bank account—so you can make a smart, confident choice.

Think You Don’t Need a Bank Account Yet? Think Again

If you’re a teen, chances are you’ve thought, “I don’t need a bank account yet—I’m not even making real money.” Totally normal. But here’s the truth: waiting too long to open a bank account is like trying to learn to drive the day before your driving test. You’ll wish you had started earlier.

A bank account isn’t just for adults—it’s your first real tool for managing money, building habits, and staying in control. Whether you're earning allowance, babysitting, doing side gigs, or just getting birthday cash, it’s time to learn how this works.

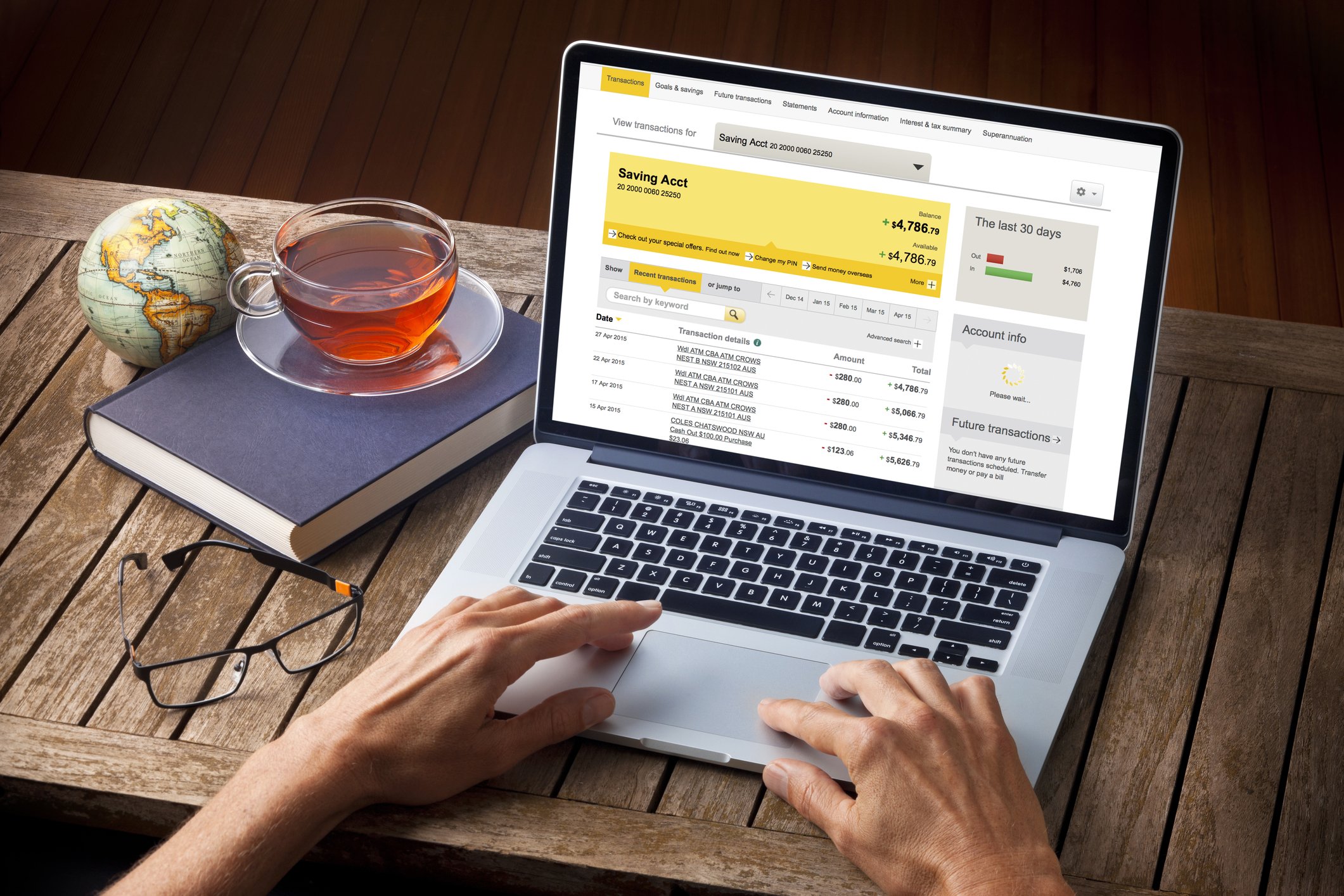

Mobile Banking for Teens: What’s Great, What’s Not

Managing money from your phone? Sounds pretty cool, right? Mobile banking apps have changed the way we handle our cash, making it easier than ever to check balances, transfer money, or even set savings goals—all from the palm of your hand. For teens just starting to take control of their finances, mobile banking can feel like a superpower. But just like any tool, it comes with both perks and pitfalls.

In this post, we’re breaking down what makes mobile banking great for teens—and what to watch out for. Whether you’re new to money management or already tracking your spending like a pro, understanding how mobile banking apps really work can help you make smarter, safer choices with your money.