Your First Bank Account? Here's What You Need to Know

Introduction

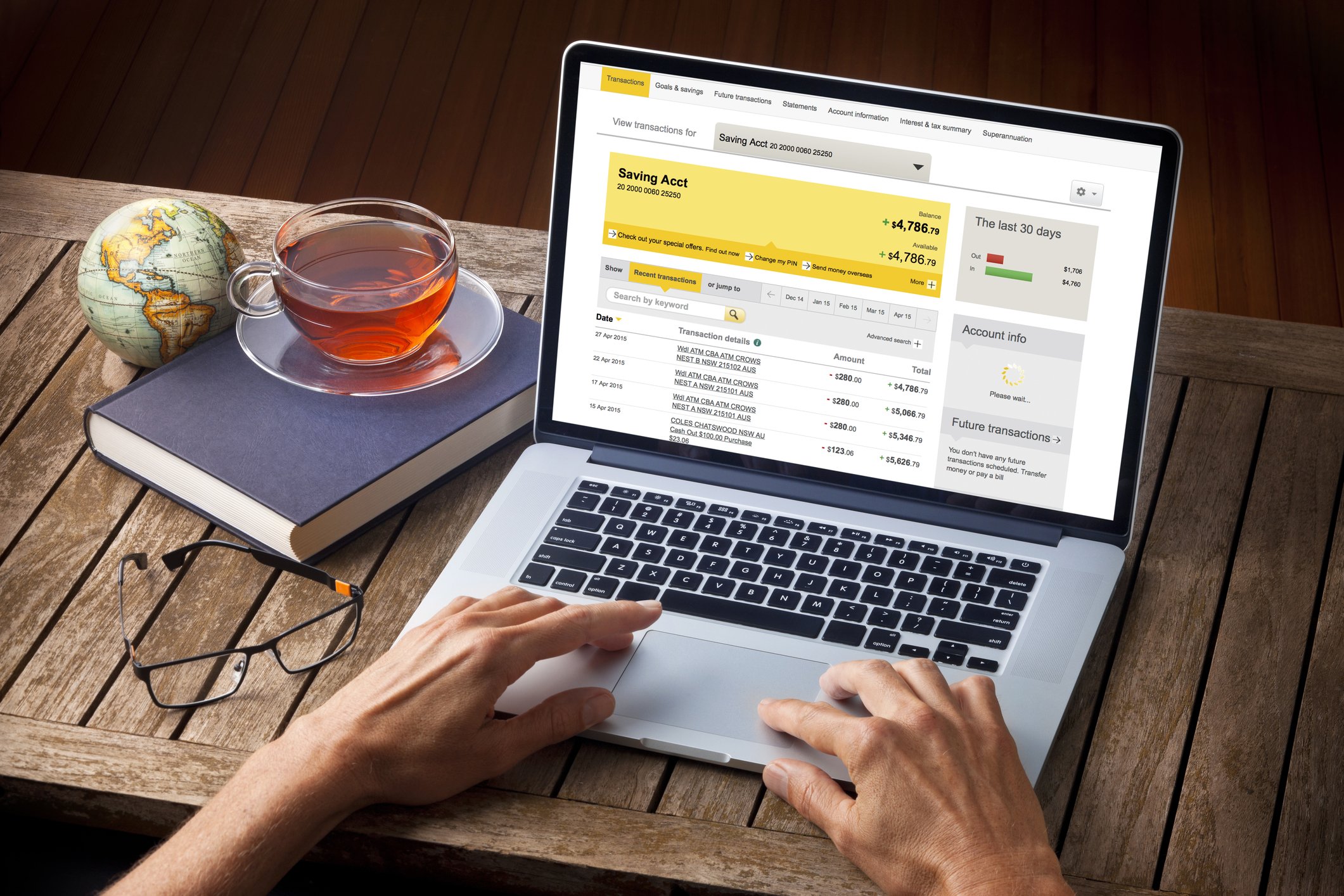

Opening your first bank account is a big step toward becoming more independent and managing your own money. Whether you're saving your birthday cash, getting paid from a part-time job, or just want to buy things online safely, a bank account is your gateway to adulting.

But where do you start? What do you need? And how do you make sure you're choosing the right one?

Let’s break it all down, step by step.

Why Open a Bank Account?

Here’s why having your own bank account is super useful:

It’s safer than cash. You won’t lose your money if your wallet goes missing.

You can get paid easily. Wages, allowances, or even refunds go straight in.

It helps you save. Many banks have built-in saving tools or rewards.

You learn money skills. Managing your own account helps you budget and plan.

“I opened my first account when I got my Saturday job at 16. It felt so good seeing my pay hit my own card!” – Jamie, 17

“Helping teens open and use their first bank account is one of the best ways to teach financial responsibility early. It gives them real-world experience with saving, budgeting, and spending wisely.”

What Types of Bank Accounts Are There?

1. Youth Accounts (Ages 11–17)

Perfect for under-18s

No fees, no overdrafts

Comes with a debit card

Parent/guardian may need to co-sign

2. Student Accounts (16–18+ with proof of education)

Extra perks for students (e.g. free railcards)

Overdrafts available (be careful!)

Useful for college and sixth-form students

3. Basic Current Accounts

General-use account for anyone 18+

No monthly fees, but fewer extras

What You’ll Need to Open an Account

To open your first bank account, you’ll need to provide a few key documents. Most banks will ask for proof of identity, such as a passport, birth certificate, or a student ID card. You’ll also usually need proof of your address. This can be a letter from your school, a bank letter sent to your home, or an official letter from the NHS or another recognised source.

If you're under 16—or under 18 in some cases—a parent or guardian may need to be involved in the application. They might need to come with you to the bank or provide their own identification.

Planning to open a student account? In that case, the bank will typically ask for proof that you’re in full-time education, such as a sixth-form or college ID or a UCAS confirmation letter.

If you don’t have all the usual documents, don’t worry. Many banks offer flexible options and may accept alternative forms of ID or allow online verification through their app.

How to Choose the Right Bank for You

Not all banks are created equal. Some are traditional, others are online-only. Here’s what to look for:

Key Things to Compare:

Monthly fees – Most youth accounts are free

Mobile app features – Budget tracking, notifications, freeze card

ATM access – Can you get cash out easily?

Extras – Rewards, learning tools, savings pots

How to Open a Bank Account – Step by Step

You’ve picked a bank—now what?

1. Check your age

Make sure you qualify (and if your parent needs to be involved).

2. Gather your documents

ID and proof of address. Some apps let you scan them.

3. Apply online or in branch

Most banks allow fully online sign-up—some even via smartphone.

4. Verify your identity

Follow the steps from the bank: selfie, document scan, or email upload.

5. Activate your card

Once it arrives, activate it via the app or online.

Using Your Account Safely

Don’t share your PIN – even with friends

Freeze your card if it’s lost

Watch out for scams – no bank will text you asking for your PIN

Use strong passwords on your banking app

Common Mistakes to Avoid

Spending all your money without budgeting

Ignoring small charges or going into negative

Forgetting to track subscriptions like Spotify or gaming services

Using unsafe public Wi-Fi for mobile banking

What Comes Next?

Once your account is set up, you're in control. Try these next steps:

Set a savings goal (e.g. new phone, uni fund)

Use budgeting tools in your bank’s app

Learn about interest and how savings grow over time

Explore junior ISAs or savings accounts for teens

Final Thought

Your first bank account is more than just a place to stash cash—it’s your first step into managing money like a pro. With the right account and some smart habits, you’ll be building strong financial skills before you even turn 18.

So go ahead—choose the right one, open it with confidence, and take control of your money.

FAQ’s

-

Yes! Many banks offer youth accounts from age 11. You’ll likely need a parent or guardian to come with you.

-

Nope. You don’t need to be earning to open a bank account—it can be used to store pocket money or gifts too.

-

Yes, as long as you follow safety tips: use strong passwords, avoid sharing login info, and never click suspicious links.

-

Use your app to freeze it immediately. Then request a new one—usually arrives in 3–5 days.

-

There’s no one-size-fits-all, but Monzo Teen is great for app lovers, while NatWest Adapt is solid for beginners. Check the comparison table above for more.