Think You Don’t Need a Bank Account Yet? Think Again

Introduction

So, you think a bank account is just for grown-ups with bills, taxes, and mortgages? Think again.

Even if you’re still in school, only working part-time, or mostly using cash or PayPal, a bank account can give you a serious head start. It's not about being "more adult"—it’s about gaining control of your money and your future.

Here’s why not having one could hold you back, and what you can do about it.

Why Some Young People Avoid Bank Accounts — and Why That’s a Problem

You’re not alone if you’ve been putting it off. These are common reasons young people skip getting a bank account:

“I don’t earn enough.”

You don’t need a full-time job to benefit. Even small amounts—birthday money, part-time pay, or side hustle income—need a safe place to go.“I just use PayPal, Revolut, or cash.”

Those are handy, sure. But they’re not a substitute for a real current account that gives you full access to financial tools.“Banking is for adults.”

Not true. Many UK banks offer special accounts for teens aged 11–17, with no fees and no overdrafts.“It seems complicated.”

Opening an account is often easier than setting up a new app—especially now that most banks offer online applications.

The bottom line? Avoiding a bank account might seem chill now, but it could lead to frustration later.

“Learning how to manage money during your teen years lays the groundwork for future financial success. A bank account is a great first step.”

5 Reasons to Open a Bank Account Sooner Than Later

1. Keep Your Money Safe

Cash can get lost or stolen. A bank keeps your money secure and insured. Even if your card is lost, your money’s not.

2. Get Paid Properly

Employers usually pay directly into a bank account. No account = no job income. Same for benefits, freelance payments, or money from apps like Depop or Fiverr.

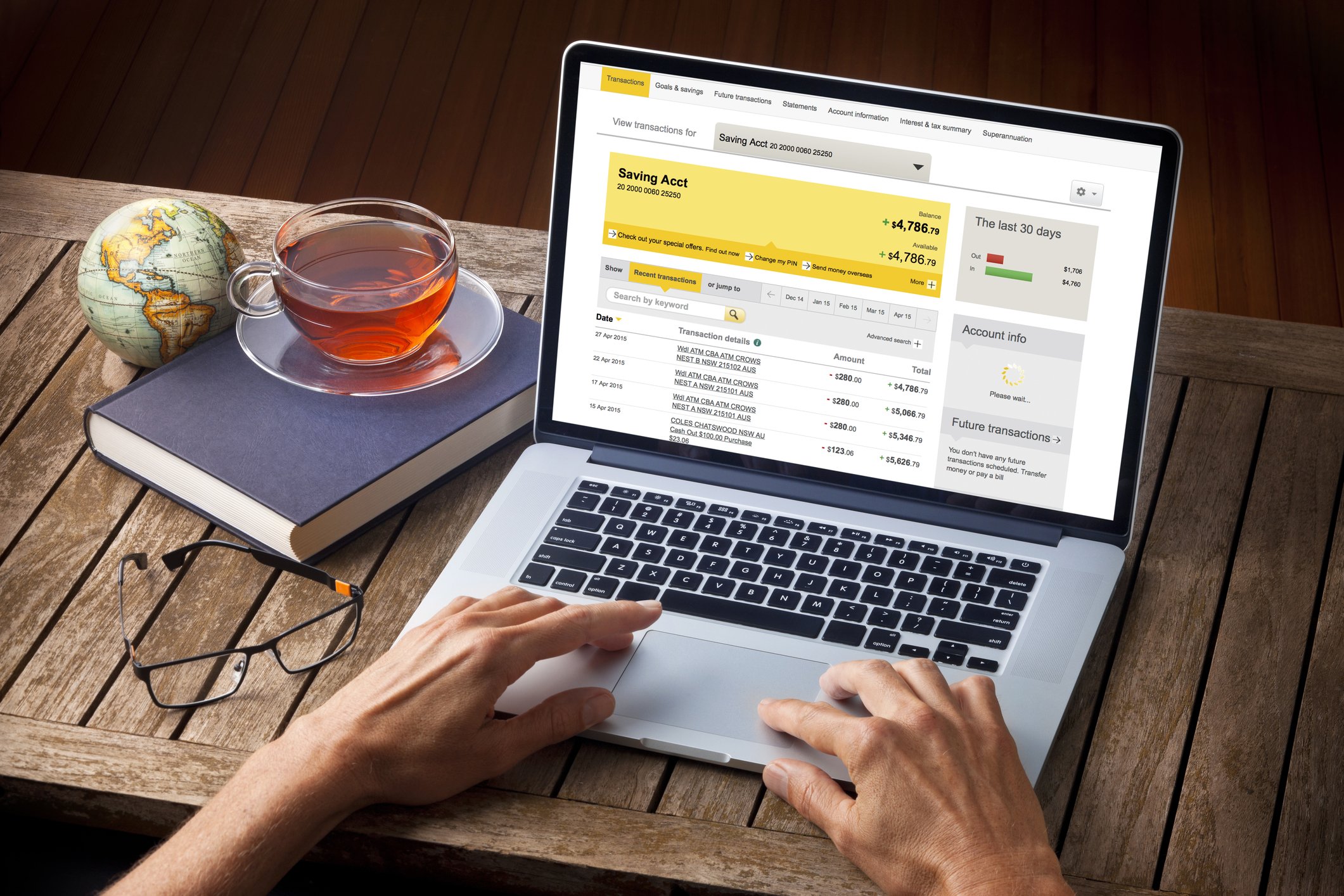

3. Manage Your Spending Like a Pro

With a banking app, you can track every penny—see where your money’s going and how to save more.

4. Build Financial Skills Early

You’ll learn to budget, spot scams, and manage money responsibly—all before things get serious.

5. Set Yourself Up for the Future

The sooner you start, the better your chances of getting access to things like student accounts, credit cards, or car loans later on.

Real Moments You’ll Regret Not Having One

Still not convinced? Here’s where no bank account becomes a real headache:

Can’t buy something online because you don’t have a debit card.

Get offered a job but can’t get paid without bank details.

Lose your cash and there’s no way to recover it.

Want to go on a trip or book tickets—but you can’t pay online.

Need to send or receive money quickly—but no bank means awkward workarounds.

How to Open a Bank Account – It’s Easier Than You Think

You don’t need to walk into a big, scary building wearing a tie. Here's what to expect:

What You’ll Need:

Proof of ID (passport or provisional driving licence)

Proof of address (can often be a letter from your school, NHS, or a parent/guardian)

Can You Do It Online?

Yes! Many banks let you apply through their apps or websites.

Best Features to Look For:

No fees or overdrafts

Easy-to-use mobile app

Instant notifications

Parental controls (for under 16s)

Banks That Offer Accounts for Under 18s (UK Examples):

HSBC MyAccount (11–17)

NatWest Adapt Account (11–17)

Lloyds Smart Start (11–15, joint with a parent)

Starting Now Sets You Up for the Future

Opening your first bank account is more than a formality—it’s a power move.

You're taking control of your finances, learning essential skills early, and building trust with the system you’ll rely on later for student finance, renting, or even buying a car.

It’s not about growing up too fast. It’s about being ready when life starts asking more of you.

Final Thought

Waiting for “the right time” might sound reasonable—but the truth is, the right time is now.

Whether you're earning a little or a lot, whether you're 13 or 18, your first bank account is your first step toward financial independence. And it doesn’t have to be scary or complicated.

So go ahead—take control of your money, before it takes control of you.

FAQ’s

-

Most banks allow you to open a youth account from age 11. Some offer teen accounts from 13 or 16, and you can usually open a standard adult current account at 18.

-

If you're under 16, many banks will need a parent or guardian’s approval—or require a joint account with them. Over 16? You can often do it solo.

-

Yes. Teen accounts usually come with a Visa or Mastercard debit card, which you can use online, in shops, or to withdraw cash.

-

Some banks accept letters from school, college, or a parent’s utility bill with your name on it. Check the bank’s website before applying.

-

Yes, as long as you follow good security habits: don’t share passwords, use strong logins, and watch out for scams. Most apps offer extra protection like fingerprint login.