Swipe Smart: How Debit Cards Really Work

Introduction

Getting your first debit card can feel like a major upgrade—no more asking parents for cash or awkward IOUs when you’re out with friends. But how do these little plastic (or digital) cards actually work? And more importantly, how do you use them smartly without slipping into avoidable mistakes?

Let’s break it down—no jargon, no lectures, just facts you can use.

What Is a Debit Card?

A debit card is like a digital version of your wallet. When you use it, you're spending your own money, directly from your bank account (usually a checking or current account). That’s the biggest difference between debit and credit cards:

Debit = your money. Credit = borrowed money.

You can use debit cards:

In stores (swipe, tap, or chip)

Online (like Amazon or ASOS)

At ATMs (to take out cash or check your balance)

Quick Tip: You can’t spend what you don’t have—unless overdraft is turned on (more on that later).

“Learning how to use a debit card responsibly is a foundational step in financial literacy for teens. It teaches budgeting, accountability, and real-world consequences—all through one simple swipe.”

What Happens When You Swipe?

Ever wonder what goes on behind the scenes after you tap your card? Here's the short version:

You swipe/tap/insert your card.

The store sends a request to your bank: “Do they have enough money?”

Your bank says yes (or no), and the transaction is approved or declined.

The money is “held” or taken out of your account—often instantly.

A few days later, the transaction is fully processed (settled).

💡 Example: You buy a smoothie for £4.50. Your balance drops by £4.50 instantly or within a few minutes.

Pros of Using a Debit Card

No debt – You’re only spending what you’ve already got.

Widely accepted – Works in most shops and online stores.

No interest charges – Unlike credit cards, there’s nothing to repay.

Budget-friendly – Easier to keep track of spending.

Cons (and Common Mistakes)

Overdraft fees – If you spend more than what’s in your account and don’t realise, some banks charge you.

Limited fraud protection – If someone steals your card and drains your account, it can take longer to get your money back.

No credit building – Debit cards don’t help you build a credit score (you need credit cards or loans for that).

Smart & Safe Debit Card Tips

Using a debit card isn’t just about tapping and walking away. Here’s how to swipe smart:

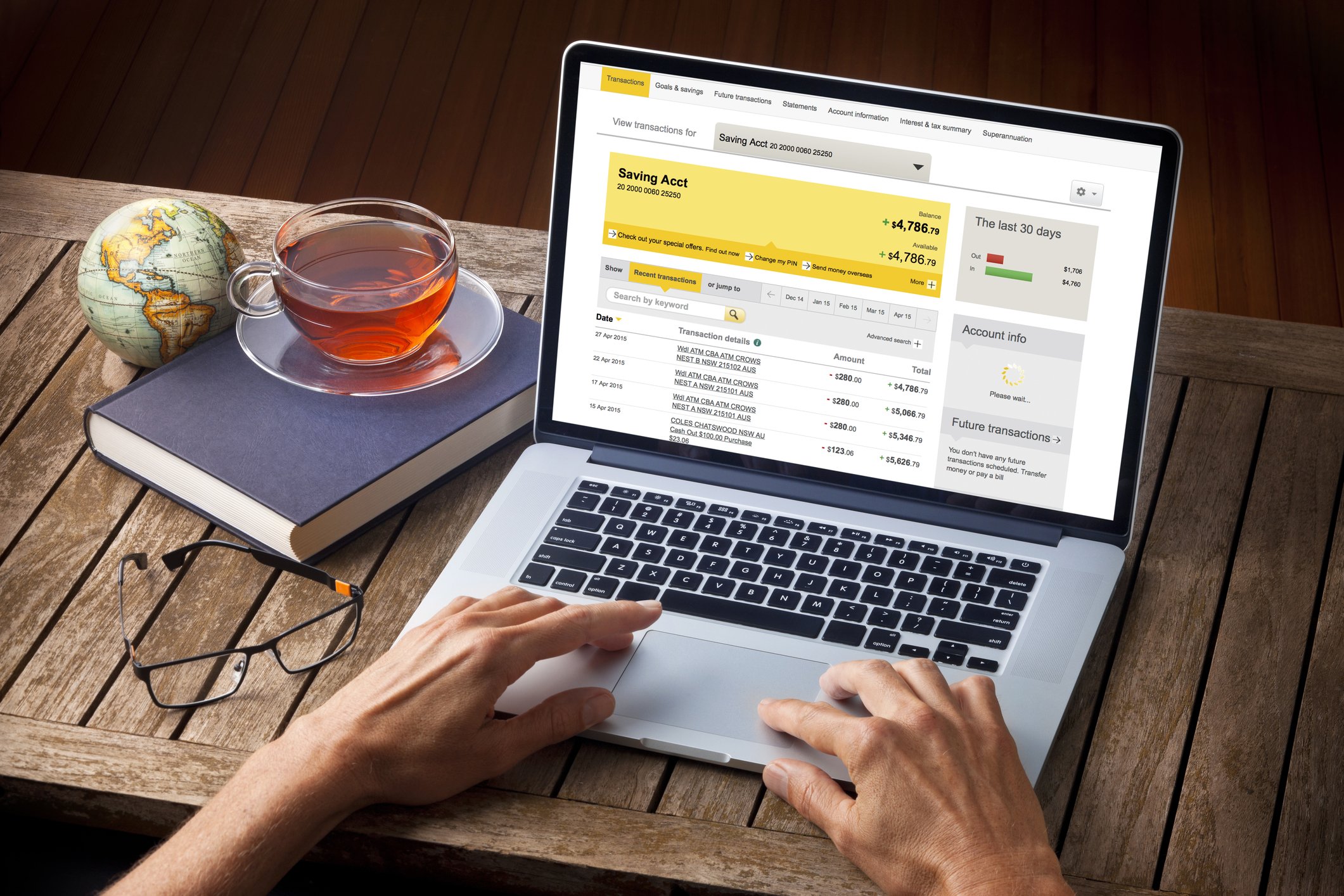

1. Know Your Balance

Check your bank app regularly. Don’t guess—know exactly how much you have.

2. Use Spending Alerts

Most banking apps let you turn on push notifications every time your card is used. Handy for spotting suspicious activity fast.

3. Avoid Overdraft Settings

Some banks let you spend slightly more than you have—but charge you for it. If you’re new to managing money, consider turning overdraft OFF.

4. Be Cautious Online

Only use your card on trusted websites. Look for “https://” and avoid random links or sellers that seem sketchy.

5. Protect Your PIN

Never share your PIN. Cover the keypad at ATMs and card readers. Don’t write it on the back of your card (seriously—people do that).

Debit Card Myths (Busted)

“Debit cards are safer than credit cards.”

Not quite. Credit cards often have better fraud protection.

“I can build credit with a debit card.”

Nope. Debit card use doesn’t go on your credit report.

“My bank will always stop me from overspending.”

Only if overdraft protection is off. If it's on, you can spend more than you have—and get charged for it.

Debit Cards for Teens: What You Should Know

If you're under 18, you might:

Need a parental co-signer to open an account

Be eligible for a teen checking account with a card designed for you

Get a prepaid debit card (a bit different—it’s not linked to a bank account, and you can only spend what’s been loaded onto it)

Teen accounts often come with limits (like how much you can withdraw daily) and built-in safety features.

Look into teen-friendly options like Monzo, Revolut, or GoHenry if you’re in the UK.

Final Thought

Debit cards are a great first step into the world of money management—but only if you know how they work. If you:

Check your balance regularly

Spend within your means

Keep your card and PIN secure

Understand fees and limits

...then congrats—you’re officially swipe smart.

FAQ’s

-

Yes! Many banks offer teen checking accounts or youth cards with parental permission. These often come with spending limits, app controls, and financial education features. You’ll usually need a parent or guardian to help open the account.

-

A debit card pulls money directly from your bank account, while a prepaid card must be loaded with money first—it’s not linked to a bank account. Prepaid cards can be a good option if you’re younger or want to avoid overspending.

-

If your account balance is too low, the payment might be declined, or you could go into overdraft (spending more than you have). Some banks charge fees for overdrafts, so it’s a good idea to turn that setting off if you want to avoid surprises.

-

Yes, as long as you're careful. Only shop on secure websites (look for “https” and trusted retailers), and avoid using public Wi-Fi when entering card info. Turning on spending alerts and using virtual cards (if available) adds an extra layer of safety.

-

Unfortunately, yes. If someone gets access to your card or PIN, they can drain your account. That’s why it’s important to protect your PIN, enable notifications, and report lost or stolen cards immediately. Most banks offer fraud protection, but it may take time to get your money back.