Savings vs. Current Account: What’s the Real Difference?

Introduction

When it comes to managing your money, opening a bank account is often the first step. But with different account types available, it’s easy to get confused — especially between savings accounts and current accounts. So, what exactly is the difference between the two, and which one should you be using?

Let’s break it all down simply and clearly.

What Is a Savings Account?

A savings account is designed for one thing: saving money.

Think of it as a secure place to store cash that you don’t need to spend immediately. In return for keeping your money with the bank, you often earn interest — a small percentage paid to you over time. Savings accounts are ideal for short- or long-term goals, like saving for a holiday, emergency fund, or a big purchase.

Key Features:

Earn interest on your balance

Limited number of withdrawals per month (in some cases)

Best for: students, young adults, anyone with a savings goal

What Is a Current Account?

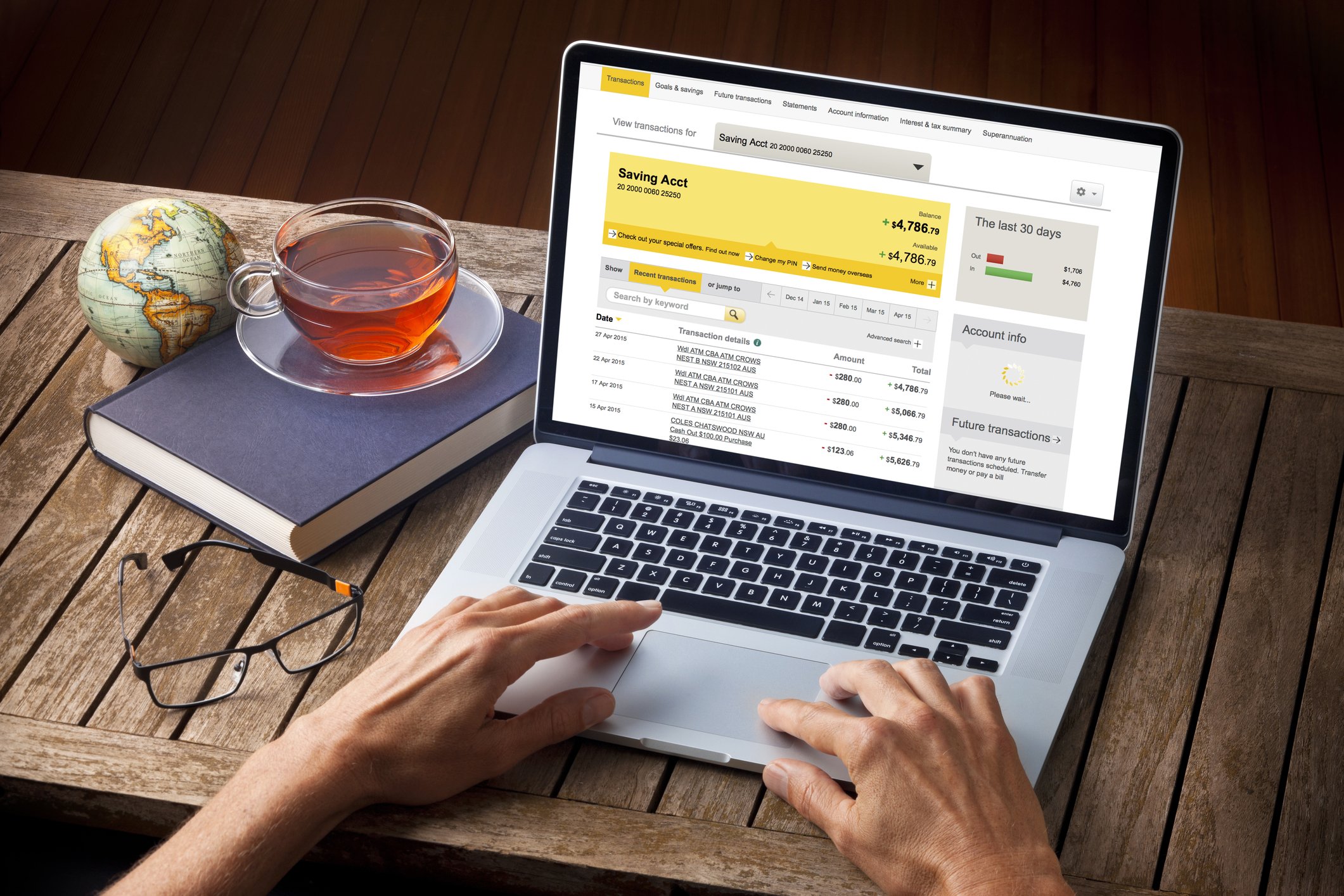

A current account (also known as a checking account in some countries) is built for daily use. It’s the account you use to get paid, pay bills, shop, transfer money, or withdraw cash — basically, for anything involving regular transactions.

These accounts rarely earn interest but offer more flexibility, often coming with a debit card, overdraft options, and online banking.

Key Features:

Unlimited transactions

Used for day-to-day money management

Best for: workers, business owners, anyone managing regular payments

“It’s important for teens to understand how different bank accounts work early on. A savings account builds long-term habits, while a current account teaches day-to-day money management.”

Savings vs. Current Account: Key Differences

The main difference between a savings account and a current account comes down to how you use the money.

A savings account is intended for setting money aside and earning interest. It’s a good choice if you’re working towards a goal or want to build an emergency fund. These accounts often limit the number of withdrawals you can make each month and may not come with a debit card. While they’re great for growing your savings, they’re not designed for everyday spending.

On the other hand, a current account is made for daily use. It’s the account you’d use to receive wages, pay bills, shop online, and withdraw cash. Current accounts typically offer unlimited transactions, include a debit card, and may offer features like overdrafts and direct debits. However, they usually don’t earn interest — or if they do, it’s very low.

In short, if you're looking to save money, a savings account is the better option. If you need an account for everyday transactions, a current account is the way to go.

Pros and Cons

Savings Account

Pros:

Earns interest

Encourages saving habits

Often no monthly fees

Cons:

Limited transactions

Not suitable for regular spending

Current Account

Pros:

Easy access to funds

Unlimited daily transactions

Comes with debit card and online banking

Cons:

Usually no interest

May come with overdraft or monthly fees

How to Choose the Right One

Not sure which one to go for? Here’s a simple way to decide:

Choose a savings account if:

You want to grow your money slowly with interest

You have a specific goal (holiday, emergency fund, new phone)

You want to limit how often you dip into your funds

Choose a current account if:

You need regular access to your money

You’re receiving wages, paying bills, or making daily transactions

You want banking tools like debit cards and direct debits

Tip: Many people use both — a current account for spending and a savings account for goals.

Real-Life Examples

Emily (17) is saving for a new laptop. She doesn’t need to access the money regularly, so she opens a savings account and sets up a weekly transfer of £10 from her current account.

Mark (25) works full-time and gets paid into his current account. He uses it to pay rent, shop online, and manage his monthly budget.

Sara (19) uses both: she keeps her spending money in a current account and tucks away birthday money and part-time wages in her savings account for future plans.

Opening a Savings or Current Account

Both account types are easy to open — either online or at a bank branch.

You’ll usually need:

A valid form of ID (passport or driving licence)

Proof of address (utility bill, letter from school or employer)

A small opening deposit (sometimes)

Some accounts are available to teens or students aged 11+, but features may be limited until you’re 18.

Common Misconceptions

“I can use my savings account like a debit card.”

Not really. Many savings accounts don’t offer debit cards, and frequent withdrawals may reduce interest or trigger fees.“Current accounts always come with fees.”

Some do, especially with extras, but many banks offer fee-free basic current accounts.“I only need one account.”

Having both can help you manage money better: one for spending, one for saving.

Final Thought

In short:

Use a current account to handle your money day-to-day.

Use a savings account to set money aside and grow it over time.

Understanding the difference helps you use both accounts smartly — so you stay in control of your money and reach your financial goals faster.

FAQ’s

-

A savings account is designed to help you grow your money with interest, while a current account is for regular transactions like spending, paying bills, and receiving income.

-

You could, but it’s not ideal. Savings accounts are limited in access and may not come with debit cards or support regular transactions.

-

Most current accounts don’t earn interest — or only offer very low rates. If earning interest is your goal, go for a savings account.

-

Yes! In fact, many people do. Use a current account for daily spending and a savings account to build towards future goals.

-

No. Many banks offer youth current accounts for teens aged 11+, though features like overdrafts will be limited or unavailable.