Saving for Something? Here’s How to Make It Happen

Introduction

Got your eye on something big? Whether it's the latest phone, a trip with friends, a car, or even just some peace of mind knowing you've got cash stashed away—saving is the key. The good news? You don’t need a full-time job or millionaire parents to make it happen. You just need a plan (and maybe a little patience).

Here’s a simple, step-by-step guide to start saving for whatever you want—and actually get there.

“When teens save toward a specific goal, they learn how powerful planning and patience can be. That’s a skill that pays off for life.”

Step 1: Know Exactly What You're Saving For

Start with a clear goal. It’s way easier to stay motivated when you know exactly what you’re working towards.

Instead of:

“I want to save some money.”

Try:

“I want to save £600 for a second-hand iPhone 14 by November.”

Be specific. That means:

What you want

How much it costs

When you want it by

This is what’s called a SMART goal—and it works.

Step 2: Break It Down

Big numbers can feel scary. So break it into small, manageable chunks.

Example:

Goal: £600

Timeframe: 4 months

That’s £150/month → about £35/week

Now it doesn’t seem so huge, right?

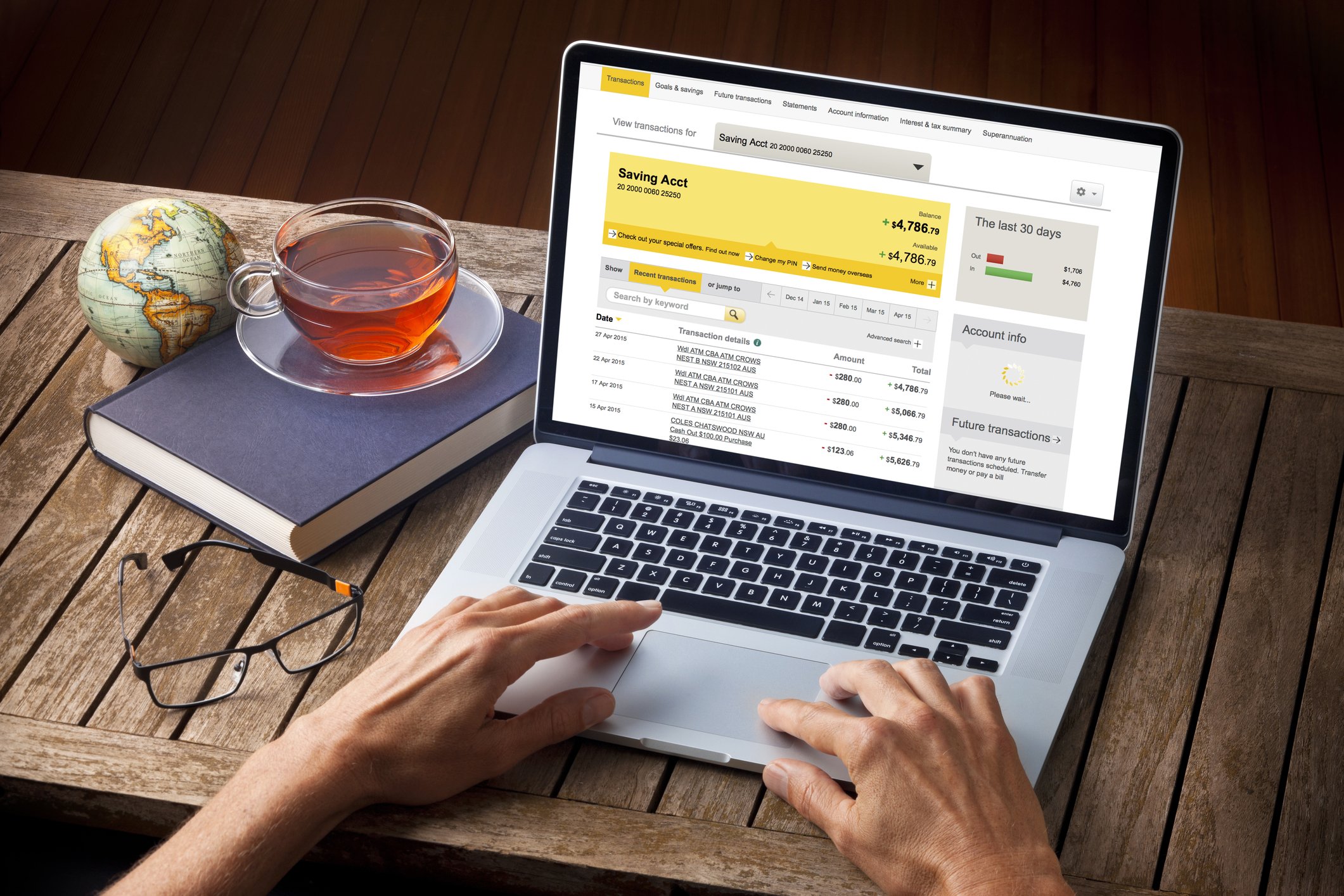

Step 3: Use a Dedicated Savings Space

Don’t just throw coins in your sock drawer.

Instead:

Open a separate savings account

Or use a banking app with “pots” or “vaults”

Try Monzo, Revolut <18, Starling Kite, or GoHenry if you’re under 18

Out of sight, out of mind = less chance of spending it.

Step 4: Track Your Spending

Before you can save, you need to know where your money’s going. You might be surprised by how much disappears on snacks, delivery fees, or random online buys.

Try:

Free budgeting apps like Emma, YNAB (You Need A Budget), or Spendee

A simple Google Sheet

Even a notebook works!

Small leaks sink ships. Plug those spending holes.

Step 5: Make Saving Automatic (If You Can)

If you get pocket money, wages, or an allowance, try to save a set amount every time.

Some banking apps let you:

Set up scheduled transfers

Use “round-up” features (save the spare change every time you spend)

It’s like paying your future self first.

Step 6: Boost Your Income

No money to save? No problem—create some.

Ideas:

Sell old clothes, books, or games on Vinted or eBay

Offer pet-sitting, tutoring, or lawn mowing

Do odd jobs for neighbours

Start a mini business (braiding, gaming lessons, reselling, custom art)

Even £5 here and there adds up faster than you think.

Step 7: Stay Motivated

Saving can feel slow—but don’t give up.

Try these:

Use a visual savings tracker (print one or draw your own)

Tick off weeks or milestones

Take a photo of what you're saving for and stick it somewhere you’ll see every day

Reward yourself at 25%, 50%, 75% checkpoints (but keep it small!)

Real Example:

"I saved £200 in 2 months by cutting out takeaways and flipping clothes I didn’t wear. It felt amazing to hit my goal—and I kept going!" – Amy, 17

What If You Fall Behind?

It’s okay. Life happens.

Recalculate: Push your deadline back or reduce your weekly target

Re-energise: Remind yourself why you started

Restart: One off week doesn’t ruin the whole plan

Quickfire Saving Hacks

Do a no-spend weekend challenge

Save every £5 note you get

Match your spending: Spend £10? Put £10 into savings

Skip one takeaway = save £15+

Avoiding Traps That Ruin Saving

Don’t lend money unless you’re okay not getting it back

Avoid “buy now, pay later” temptations

Don’t compare your progress to others—stay focused on your own goal

Final Thoughts

Saving isn’t just about money—it’s about building discipline, patience, and freedom. Every pound you save is proof that you're in control of your future.

And trust us: when you finally buy that thing you worked for? It hits different.

FAQ’s

-

Cut out unnecessary spending (like daily snacks), sell stuff you don’t use, and find small ways to earn money—then save all of it consistently.

-

Whichever works best for you. Weekly saving can feel easier to manage and keep track of, especially if you get money regularly.

-

Visual reminders, goal trackers, and breaking your goal into milestones helps a lot. Celebrate the small wins too!

-

Focus on income first—offer to help at home for extra cash, sell unused items, or do favours for family/friends that pay. Then start saving.

-

Yes! Telling friends or family can help keep you accountable—and they might even support your goal (or avoid tempting you to spend!).