Don’t Borrow Trouble: Smart Ways to Avoid Debt

Introduction

Worried about money, even when you're not in debt yet? You're not alone — and that worry might be a good thing. There's an old saying: “Don’t borrow trouble.” It means don’t take on problems before they exist. And when it comes to debt, that advice couldn’t be more true.

Debt can sneak up on anyone — a flashy phone upgrade, a night out, a “buy now, pay later” offer — and before you know it, you’re juggling payments and dodging interest charges. But here’s the good news: you can avoid most debt with a few smart choices and habits.

Let’s break down how to protect yourself from the debt trap and live with more freedom and less financial stress.

What Really Causes Debt?

Before you can avoid debt, you need to understand how it happens. Often, it's not just bad luck — it’s habits, pressure, or short-term thinking. Here's what tends to lead people into debt:

Impulse spending on things you don't really need

“Buy Now, Pay Later” traps that seem harmless but add up

Credit card misuse, especially just paying the minimum

Lifestyle inflation — spending more just because you're earning more

No emergency savings to handle surprise costs

Trying to keep up with others (especially on social media)

Did you know? The average UK household had over £2,400 in credit card debt in 2024 — and many didn’t realise how quickly it built up.

“Even small debts can form bad habits early. Teaching teens to delay gratification is a powerful tool for long-term financial health.”

Smart Habits to Avoid Debt

You don’t need to be a finance expert. These simple habits can help you steer clear of debt while still enjoying life.

1. Budget Like You Mean It

A budget isn’t about saying “no” — it’s about saying “yes” to what matters.

Try the 50/30/20 rule:

50% = Needs (rent, food, bills)

30% = Wants (fun stuff, treats)

20% = Saving/debt repayment

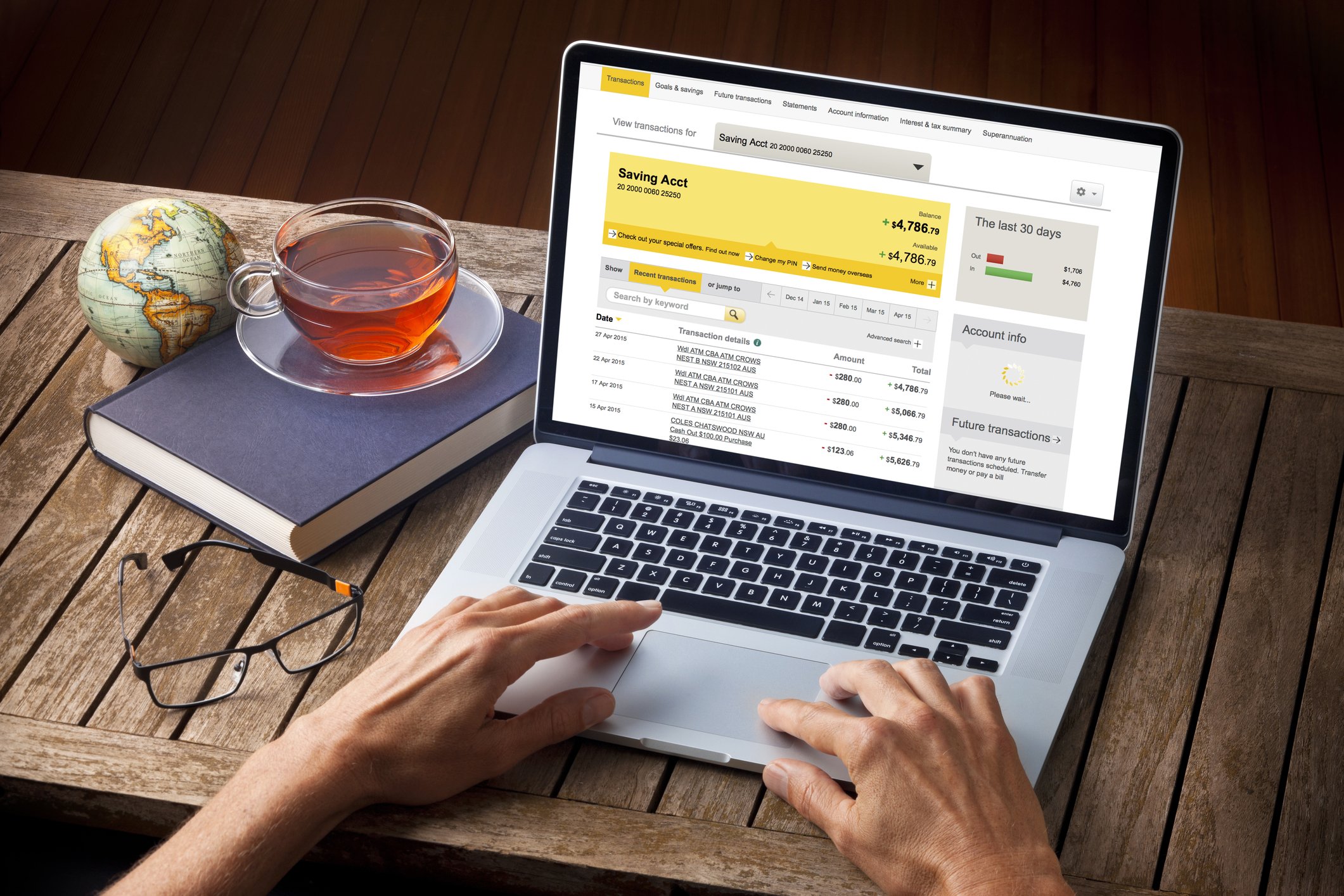

Tools to try: Monzo, Emma, Snoop, or even Google Sheets.

2. Delay Big Purchases

If you want something expensive, sleep on it. Try the:

24-hour rule: Wait a day before buying

30-day rule: Add it to a wish list and review in a month

Often, the urge passes. If it doesn’t, you’ll know it’s worth it.

3. Save Before You Spend

Instead of using credit to buy what you want now, flip the script:

Set a savings goal

Put aside a little each week

Buy it guilt-free when you have the money

Even £10/month adds up. Create “sinking funds” for things like holidays, clothes, or gifts.

4. Use Credit Wisely — Or Not at All

Credit cards aren’t evil, but they can be dangerous if used wrong:

Always pay the full balance every month if possible

Understand your APR (Annual Percentage Rate) — it’s what debt costs you

Never use credit for things you couldn’t afford with cash

Bonus tip: If you’re under 18 or new to credit, consider prepaid or student cards instead.

5. Watch Out for Buy Now, Pay Later

BNPL services like Klarna or Clearpay seem convenient — but they’re still debt.

They break purchases into smaller amounts to tempt bigger spending

Missing payments can hurt your credit score

Some charge late fees or refer you to debt collectors

BNPL usage among UK teens has surged — so be extra cautious.

6. Build an Emergency Fund

Life happens. Whether it's a cracked phone or surprise travel costs, having just £100–£300 saved can stop you from panicking — or borrowing.

Set up a separate savings pot and treat it like a “just in case” buffer.

Red Flags You're Slipping Toward Debt

You don’t need to be in debt to feel its warning signs. Look out for:

Using credit to pay for essentials like food

Making only the minimum payment on cards

Avoiding checking your bank balance

Hiding spending from friends or family

Feeling anxious or guilty after shopping

Catching these signs early means you can get back on track before things spiral.

Already in Debt? Here’s What to Do

If you’re already struggling, you’re not a failure — and you’re not alone. Here's how to get help fast:

Stop borrowing: Don’t add new purchases to credit or BNPL.

Get advice early: Free UK support is available from:

Talk to creditors: Many will offer payment plans if you're honest.

Cut unnecessary expenses: Even small changes help.

Use a debt calculator: Tools like MoneyHelper’s budget planner can help you make a plan.

Reminder: You can recover from debt — and stay out of it for good.

Debt Is Not a Lifestyle

In today’s world, debt is normalised. Credit cards, BNPL, payday loans — they’re everywhere. But that doesn’t mean you have to follow the crowd.

Avoiding debt isn’t about being boring. It’s about:

Having choices

Living with less stress

Feeling in control

Being able to say “yes” to what truly matters later

You can live well without borrowing trouble — or money.

Final Thought

Debt isn’t just about money — it’s about freedom. The choices you make today can save you years of stress tomorrow.

So next time you're tempted to borrow — stop, breathe, and ask: Is this worth the trouble?

You’ve got this. Smart habits now = financial freedom later.

FAQ’s

-

Good debt is borrowing that helps grow your future (e.g., student loans, mortgages). Bad debt is for stuff that loses value fast (e.g., shopping, nights out). Even “good” debt should be used wisely.

-

Yes — if you’re disciplined. Paying it off in full every month means no interest. But if you’re not confident, it’s safer to avoid it altogether.

-

Ideally, save at least three months' expenses as a cushion. But even £100–£300 can make a huge difference. Start small and build up.

-

Yes. Some providers now report to credit agencies. If you miss payments or use it too often, it can impact your score and ability to get credit in future.

-

Talk to someone — a parent, teacher, or a free debt advice service. You're not alone, and stress-free help is available. Don’t wait until things feel out of control.