Mobile Banking for Teens: What’s Great, What’s Not

Managing money from your phone? Sounds pretty cool, right? Mobile banking apps have changed the way we handle our cash, making it easier than ever to check balances, transfer money, or even set savings goals—all from the palm of your hand. For teens just starting to take control of their finances, mobile banking can feel like a superpower. But just like any tool, it comes with both perks and pitfalls.

In this post, we’re breaking down what makes mobile banking great for teens—and what to watch out for. Whether you’re new to money management or already tracking your spending like a pro, understanding how mobile banking apps really work can help you make smarter, safer choices with your money.

The Perks Of Mobile Banking

Instant Access To Your Money

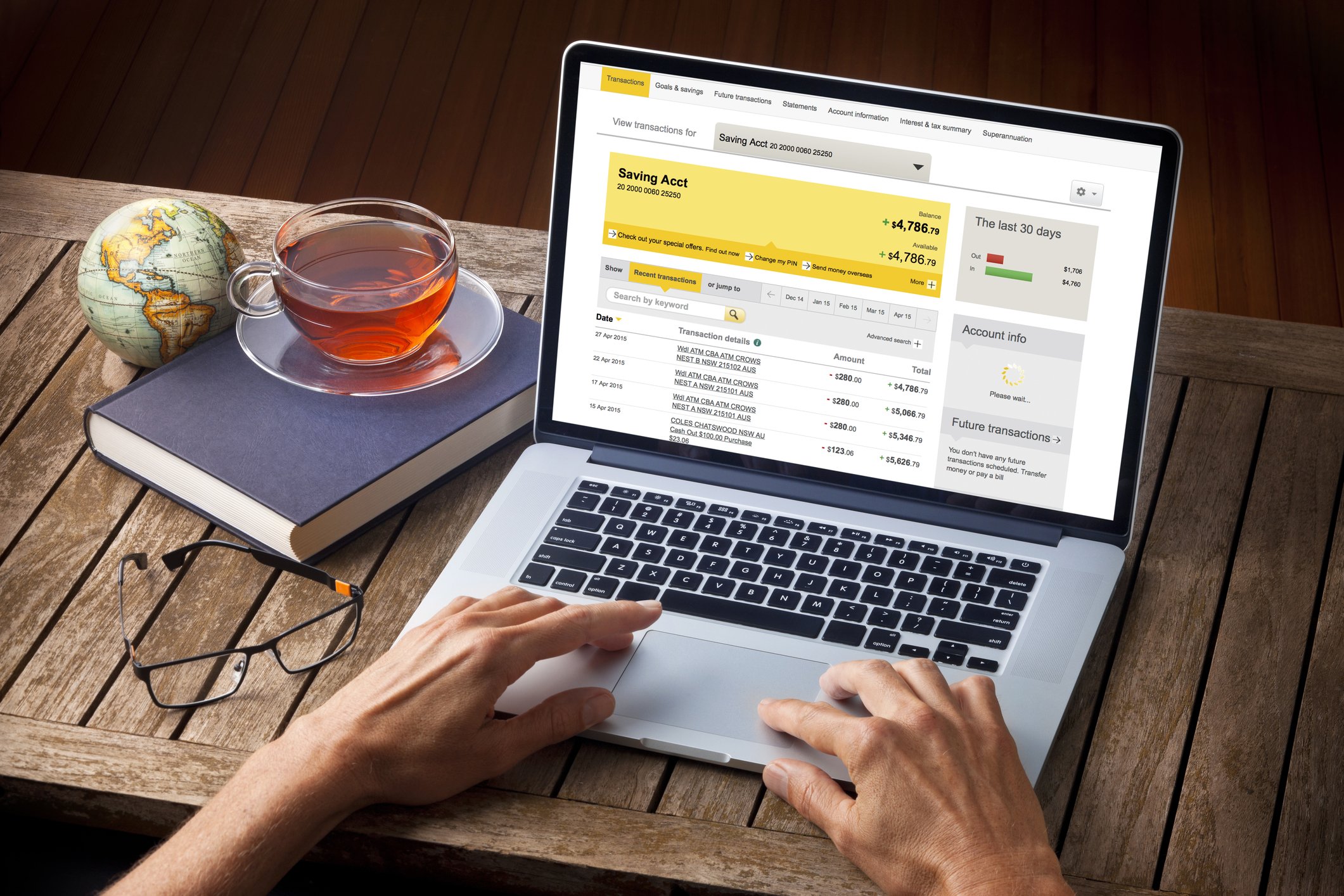

Gone are the days of waiting for your bank statement in the mail or having to drive to the ATM to check your balance. With mobile banking, you can see exactly how much you have, where you’ve spent it, and when it’s available—all in real-time. Whether you're checking your balance or keeping track of your spending, everything is right at your fingertips.

Budgeting Made Easy

Many banking apps allow you to create budgets and set savings goals. You can track your spending across categories like food, entertainment, or transportation, and get notifications when you’re nearing your limit. Plus, you can set up automatic transfers to a savings account, helping you build good financial habits from the start.

Quick Transfers

Need to send money to a friend or pay your parents back for lunch? Mobile banking apps make it easy to transfer money instantly. No more writing checks or trying to find cash. This can be especially helpful when you’re on the go or don’t carry a lot of cash with you.

Convenience Of Online Payments

Mobile banking apps also let you make payments online—whether it’s for your phone bill, a subscription service, or even shopping. Everything is streamlined, and it’s easy to pay on time, avoiding late fees and keeping your credit in good standing if you’re building it.

Downsides Of Mobile Banking

Security Risks

While mobile banking apps are designed with security in mind, there are always risks involved with digital banking. If you don’t use strong passwords or enable two-factor authentication, your account could be vulnerable to hackers. If your phone is lost or stolen, anyone with access to it could potentially access your bank account.

What to Do: Always set up a secure password, use a fingerprint or face ID feature, and enable all available security features in your app to protect your finances.

Temptation To Overspend

It’s easier to spend money when it’s just a couple of taps on your phone. Without the physical act of handing over cash, you might not feel the impact of your purchases right away. That can lead to overspending, especially when you’re not keeping an eye on your balance in real time.

What to Do: Set up notifications to alert you when you’re getting close to your budget or spend limit. Regularly check your spending to stay on track.

Lack Of Human Interaction

One downside of relying too much on mobile banking is that it can feel a little impersonal. While online banking is great for routine tasks, you might miss out on the valuable guidance and advice a banker can give you in person. Plus, if something goes wrong, it might be harder to resolve issues without direct human contact.

What to Do: Don’t be afraid to visit a bank branch or talk to a customer service rep when you have questions or need help. It’s okay to seek advice when you need it!

Relying Too Much On Technology

What happens if your app crashes or your phone dies? Some teens rely heavily on their phone for all their financial tasks, and if something goes wrong, they might not have a backup plan. Being overly dependent on digital tools without understanding the basics of finance could be a disadvantage.

What to Do: Make sure you understand how money management works offline as well, like knowing how to budget, save, and track your spending without relying on an app.

Final Thought

Mobile banking is a powerful tool for teens to take control of their finances. It offers instant access to your money, helps you budget and save, and simplifies financial tasks like sending money and paying bills. However, it’s important to be mindful of security risks, avoid overspending, and maintain a balance between digital and real-world financial knowledge.

By using mobile banking apps wisely, you can make smarter financial decisions and stay in control of your money.

Money Saving Expert is a journalistic website that aims to provide the best MoneySaving guides, tips, tools and techniques for people of all ages.