Overdrafts Explained: What They Are and How to Avoid Them

So, you’ve got your first bank account, your shiny debit card, and maybe even a bit of cash from a part-time job. You’re spending smart… until one day you check your balance and it’s below zero. Worse, your bank just charged you a fee—and you didn’t even realise you did anything wrong.

Welcome to the world of overdrafts. They can be sneaky, expensive, and completely avoidable—if you know what to watch out for.

This post breaks down what overdrafts are, the difference between agreed and unapproved overdrafts, and—most importantly—how you can avoid falling into the red.

What Is An Overdraft

An overdraft happens when you spend more money than you actually have in your bank account.

Let’s say you have £20 in your account, but you buy something that costs £25. Your bank covers the extra £5—but now your balance is negative. That’s an overdraft.

Sounds helpful, right? The problem is: most banks charge fees or interest when you go into overdraft. And if you don’t catch it quickly, those charges can pile up fast.

Agreed v Unapproved Overdrafts

Not all overdrafts are created equal. There are two main types:

✅ Agreed Overdraft (Also called “Authorised”)

This is an overdraft limit you set up in advance with your bank. It’s like a backup plan. The bank agrees to let you go into the negative up to a certain amount—say, £100 or £200—without charging huge penalties (though you still might pay interest or small fees).

Good to know:

You must apply for it and get approved.

The limit is usually low for teen or student accounts.

Some banks don’t charge interest on small overdrafts.

❌ Unapproved Overdraft (Also called “Unauthorised”)

This happens when you spend more than your balance without an agreed overdraft—or go over your limit. Banks really don’t like this.

Expect:

High fees

Interest charges

Possible declined transactions

It may also affect your credit in the future.

Pro Tip: If you’re not sure whether your account has an agreed overdraft, it probably doesn’t. Always check with your bank.

Why Overdrafts Can Be A Big Deal

For teens just starting to manage money, overdrafts can feel like "no big deal"—but they can have real consequences:

You could owe money you didn’t mean to spend.

You might get hit with multiple fees.

You could lose trust with your bank (which might affect future credit or loan options).

You might accidentally bounce payments like subscriptions or direct debits.

In short: overdrafts can turn one small mistake into a money mess.

How To Avoid Overdrafts

Here’s how to keep your account in the green and stay stress-free:

Know Your Balance

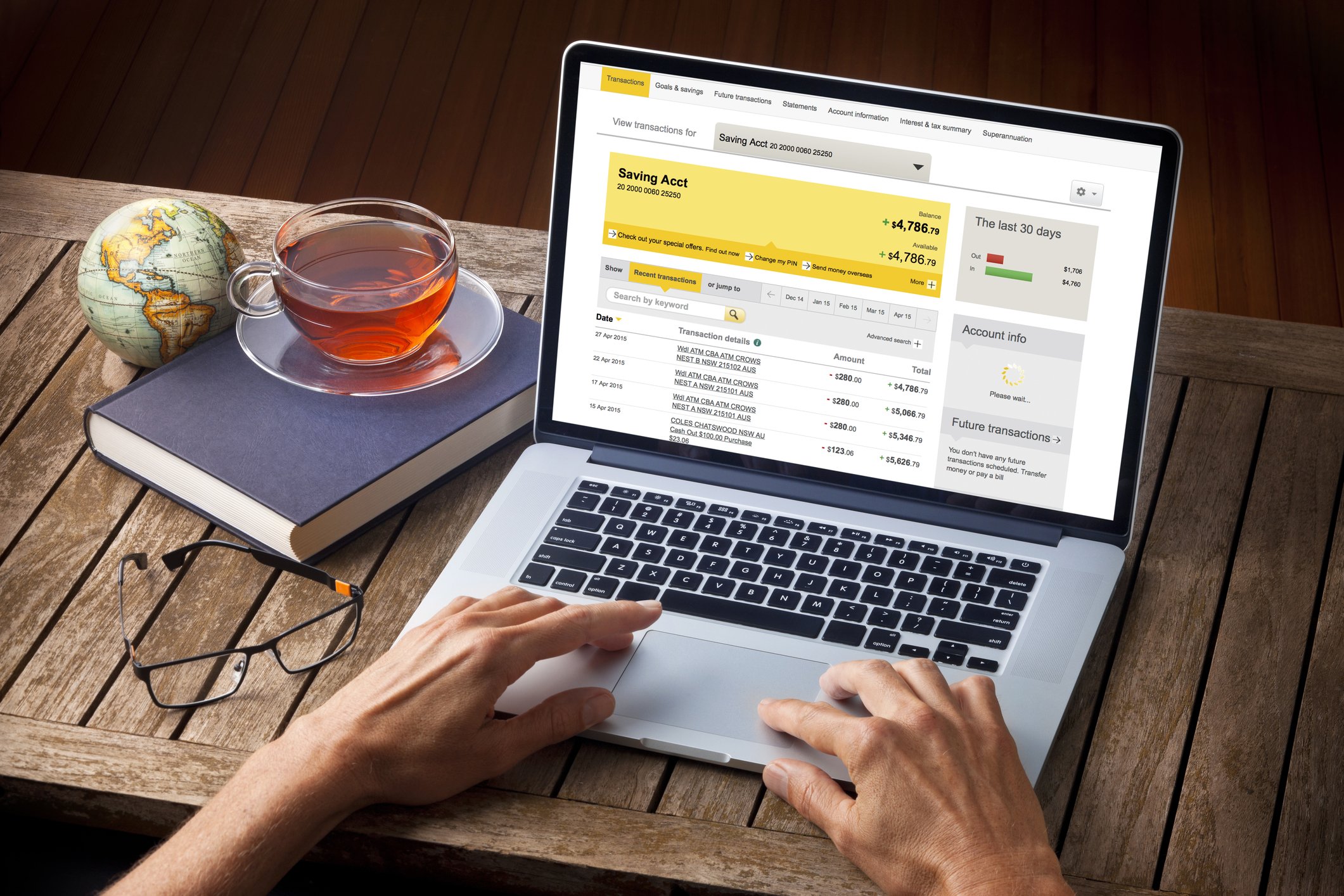

Check your bank app often. Get in the habit of knowing how much you actually have before spending.

Turn on Notifications

Most banking apps let you set up alerts for low balances or when money leaves your account.

Avoid Overdraft Settings

Some accounts let you opt out of overdrafts entirely—meaning your card will just be declined if you don’t have enough money. It’s a little embarrassing, but way better than paying fees.

Set a Budget

If you have regular income (like a job or allowance), plan how much you’ll spend and how much you’ll save. That helps you avoid overspending without even thinking about it.

Say No to Unapproved Overdrafts

If you accidentally dip into one, pay it off ASAP and call your bank. They may waive fees if it’s your first time.

Final Thought

Overdrafts aren’t evil—but they’re definitely not free money. They’re a tool that can help in emergencies, but only if you understand how they work. The key is to stay aware, plan your spending, and keep an eye on your balance.

Being smart with your bank account now helps you build good habits for life. So next time you’re tempted to swipe when your balance is low, remember: it’s better to pause than to pay later.

Money Saving Expert is a journalistic website that aims to provide the best MoneySaving guides, tips, tools and techniques for people of all ages.